Introduction

Introduction

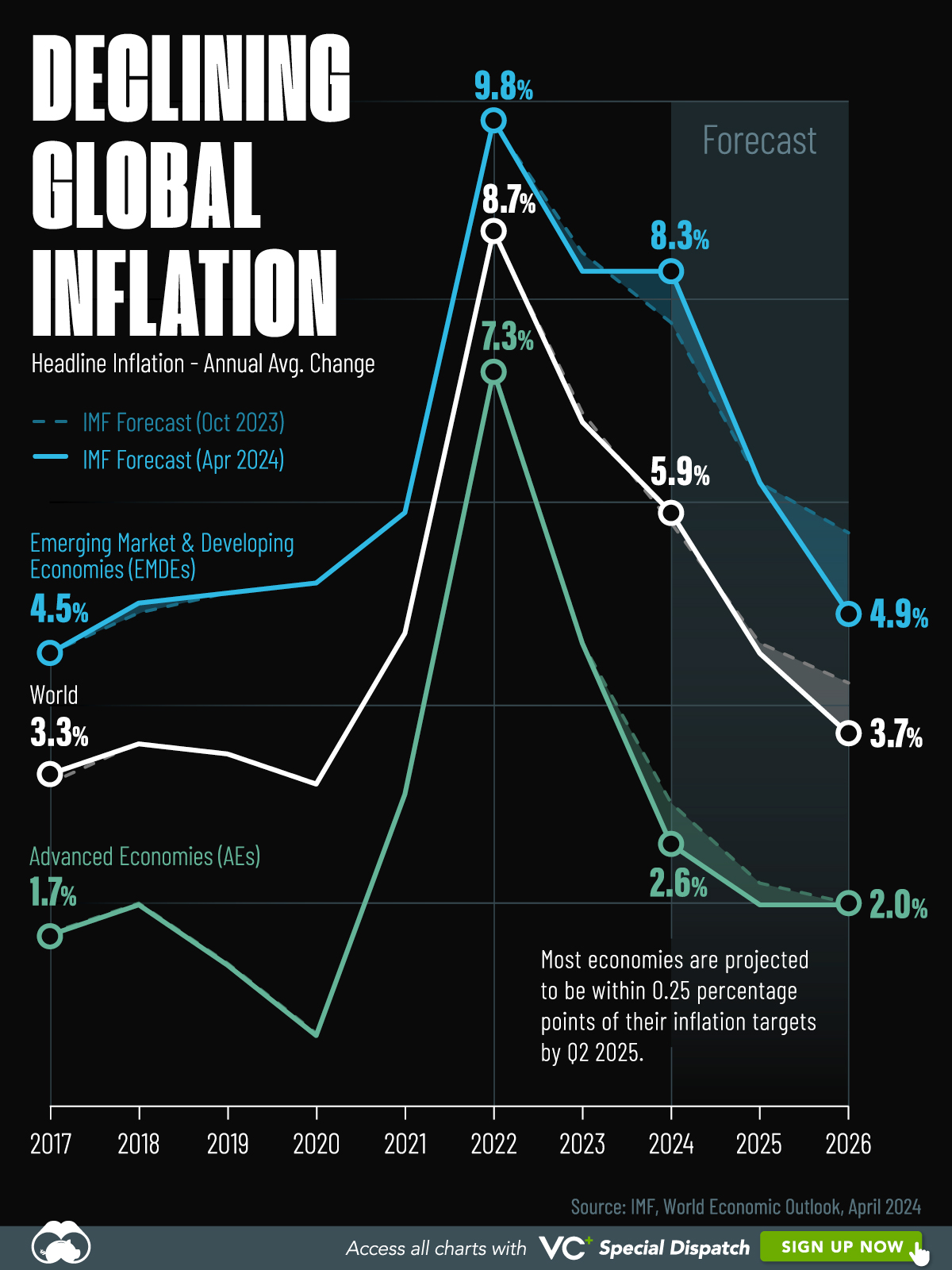

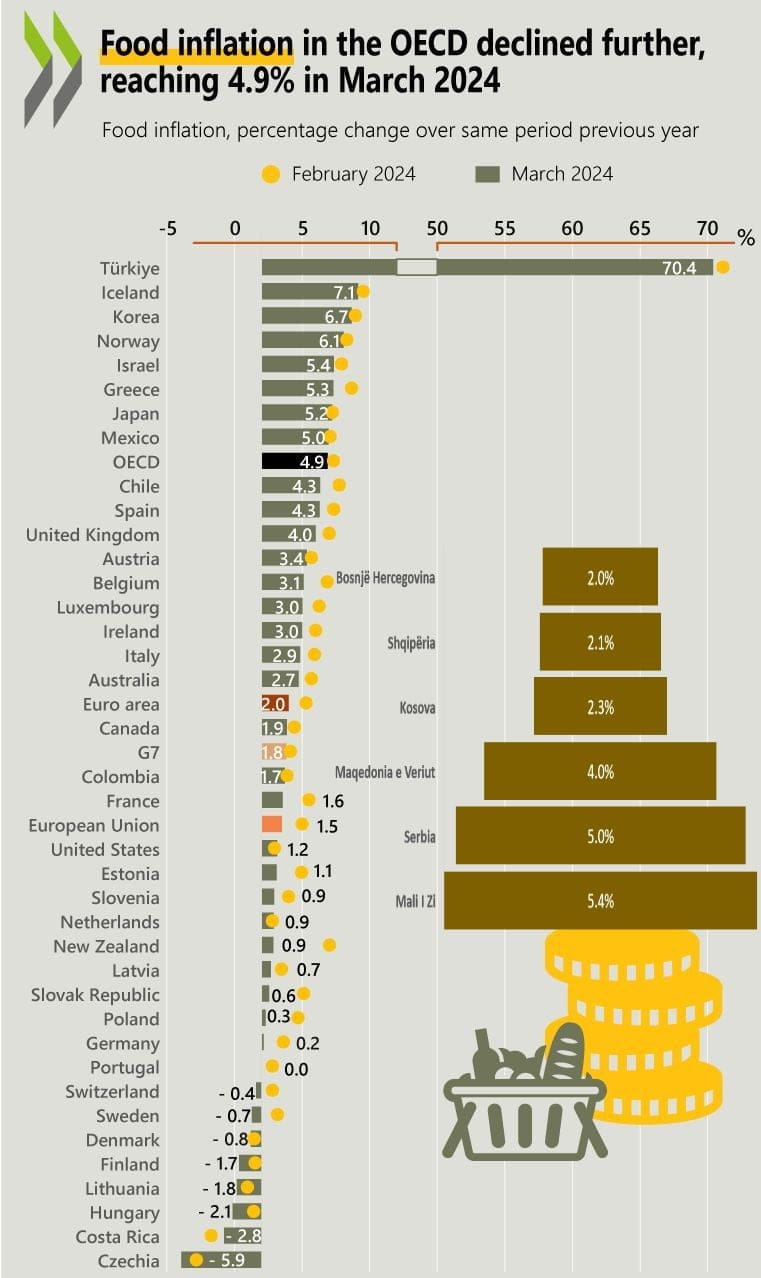

After the inflation surge triggered by the pandemic, supply-chain disruptions and energy-price shocks, 2025 is shaping up to be a year of disinflation — a gradual reduction in the rate of price increases. According to the International Monetary Fund (IMF), global headline inflation is projected to fall from around 6.7 % in 2023 to about 4.3 % in 2025. (IMF) Meanwhile, the Organisation for Economic Co‑operation and Development (OECD) expects inflation in its member economies to decline to about 3.8 % in 2025. (OECD)

But the pace and depth of recovery differ significantly among countries. Below we explore the key trends and highlight which regions and economies appear to be recovering fastest.

Key Global Trends

1. Overall disinflation is underway

- The IMF projects inflation in advanced economies to reach about 2 % in 2025, while emerging markets average about 5.9 %. (IMF)

- The OECD notes that headline inflation in G20 economies is projected at ~3.8 % in 2025 and ~3.2 % in 2026. (OECD)

- Improvement is driven by: easing energy & commodity price pressures; tighter monetary policy starting to bite; some supply-chain normalization. (Euromonitor)

2. Significant regional/country variation

- Some emerging markets still face high inflation or slower declines. (IMF)

- For example, the cumulative inflation since 2020 shows wide disparities: for instance, countries like Argentina saw extremely high cumulative inflation, while others such as India or some advanced economies saw more modest rises. (Visual Capitalist)

- In a snapshot of G20 countries in August 2025: inflation ranged from ~33.6 % in Argentina, ~33 % in Türkiye, down to ~2.3 % in Indonesia and ~2.1 % in India. (Visual Capitalist)

3. Some emerging markets are showing signs of faster disinflation

- For example, in India CPI inflation fell to a seven-month low of 3.6 % in February 2025. (McKinsey & Company)

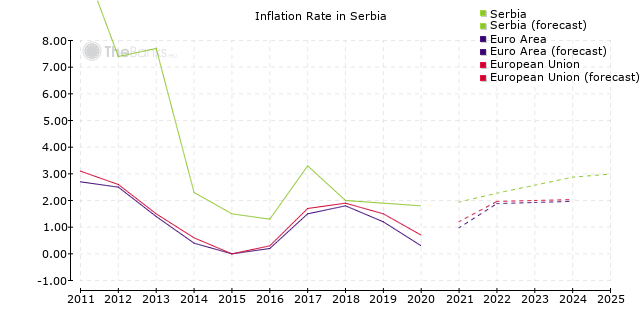

- In the Western Balkans region (WB6 countries) inflation dropped sharply average to ~3.3 % in 2024 (from ~9.3 % in 2023) with variation across countries. (World Bank)

- Lower inflation can allow central banks to shift from restrictive monetary policy to more support, boosting growth.

Countries / Regions Recovering Fastest – Case Highlights

Here are some of the most notable cases where inflation is moderating quickly or already at relatively low levels.

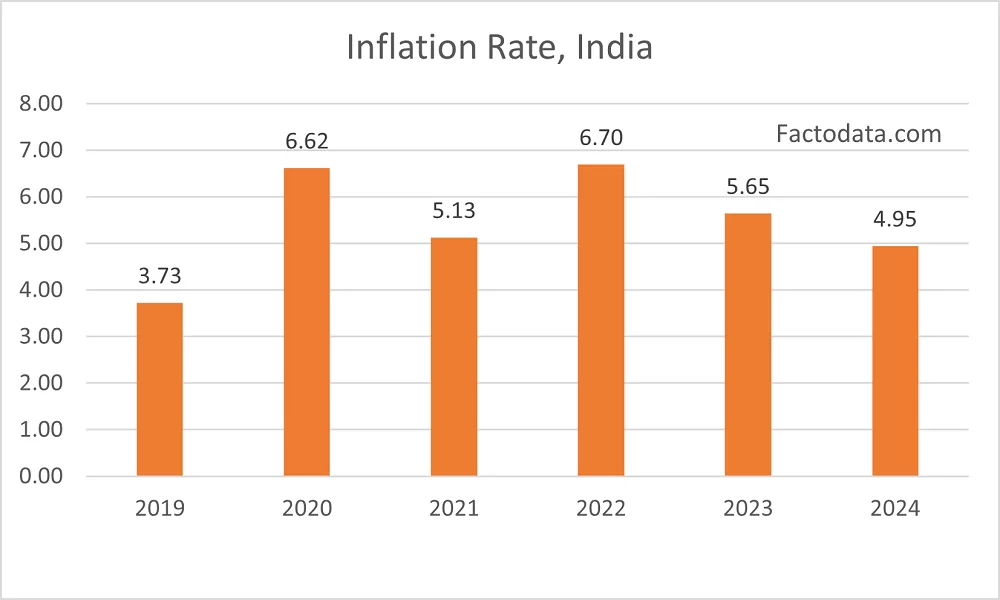

● India

- India’s CPI inflation fell to about 3.6 % in February 2025. (karriere-upgrade.mckinsey.de)

- Emerging Asia more broadly is projected to have inflation nearly on par with advanced economies (2.7 % in 2025) — partly due to early monetary tightening and price-controls. (IMF)

- The combination of domestic demand strength, improving supply conditions, and reasonable inflation makes India one of the faster “recoverers” in inflation terms.

● Western Balkans / Smaller Emerging Economies

- In the region referred to as “WB6”, average inflation dropped from ~9.3 % in 2023 to ~3.3 % in 2024. (World Bank)

- Some countries even achieved inflation in the ~1.6-2.2 % range in 2024 (e.g., Albania, Kosovo). That suggests strong disinflation and potential for monetary easing.

● Advanced Economies / OECD Countries

- In advanced economies, inflation is projected around 2 % in 2025 — approaching central-bank targets. (IMF)

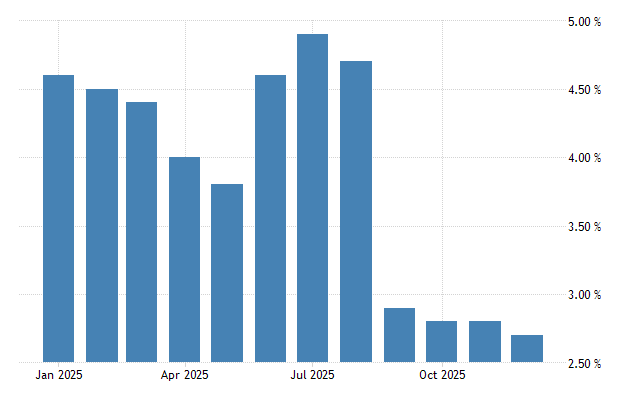

- For example, in the US, headline CPI was about 2.8 % year-on-year in February 2025. (McKinsey & Company)

- The relatively quick return toward target inflation levels means these economies are also among the fastest recovering in inflation terms — though from lower prior levels.

Why Some Countries Are Recovering Faster

Several factors help explain why certain countries are seeing faster inflation recoveries:

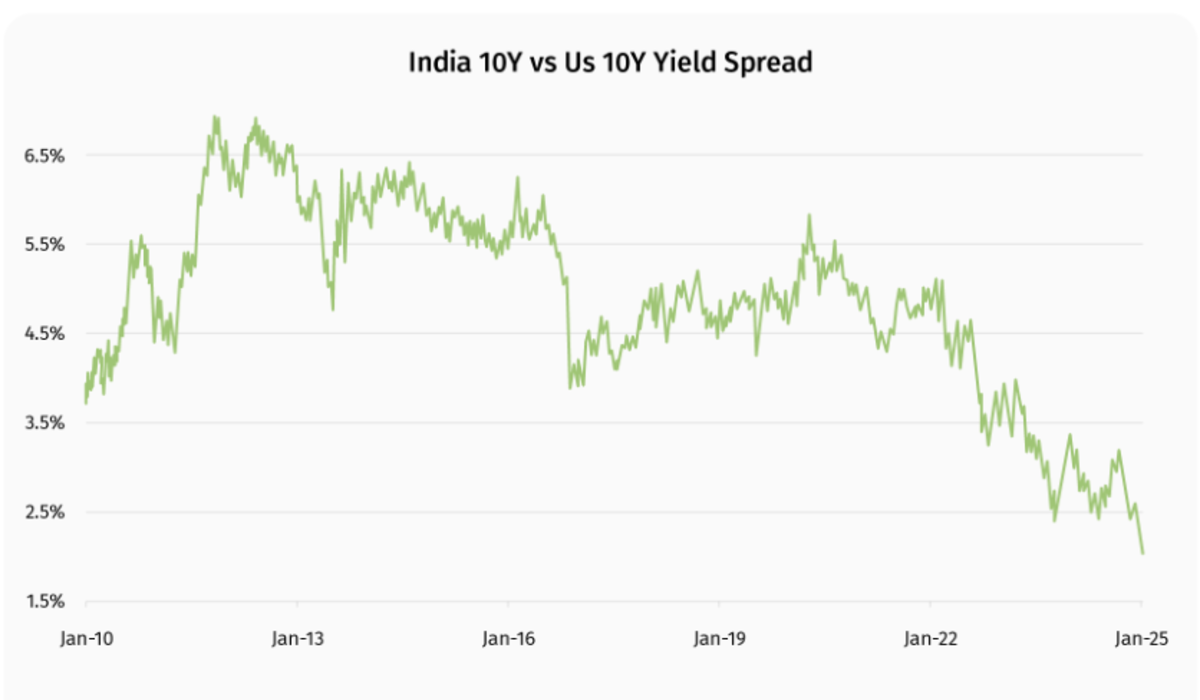

- Early and strong monetary tightening (raising interest rates) to curb inflation expectations.

- Improved supply-chain and logistics bottlenecks easing.

- Lower commodity and energy price shocks feeding through less strongly.

- Domestic structural factors: competitive labour markets, better fiscal policy, more stable exchange rates.

- For smaller economies, once high inflation episodes may respond faster once shocks abate.

Risks & Caveats

- Disinflation does not mean zero inflation — in many cases the pace remains above target or is volatile. For example, core inflation (excluding food & fuel) may stay stubbornly higher. (McKinsey & Company)

- Some countries still face persistent inflation: high-inflation economies like Argentina, Türkiye remain far behind. (Visual Capitalist)

- External risks: trade restrictions, new supply disruptions, commodity price spikes could reverse the progress. The OECD warns of “important differences across countries and regions”. (OECD)

- Even in “fast-recovering” countries, inflation reductions may not yet translate into strong real wage growth or improved living standards.

Implications for Investors, Businesses & Consumers

- Lower inflation can support lower interest rates → borrowing costs fall → investment opportunities rise.

- Consumers may regain some purchasing power if wage growth holds.

- For businesses: more predictable pricing helps planning; but those selling into high-inflation markets still face risks.

- For emerging-market investors: watching which countries control inflation fastest may help differentiate winners vs laggards.

Conclusion

2025 is shaping up as a year in which inflation pressures moderate globally — but the pace of recovery is uneven. Countries like India, some Western Balkan economies and many advanced economies are showing relatively faster progress.

Meanwhile, others continue to struggle with high inflation legacies or structural issues. For policymakers, the challenge is maintaining momentum; for investors and businesses, recognising which economies are achieving better inflation control may offer strategic insight.

Meanwhile, others continue to struggle with high inflation legacies or structural issues. For policymakers, the challenge is maintaining momentum; for investors and businesses, recognising which economies are achieving better inflation control may offer strategic insight.